Every so often a trading framework appears that marries simplicity with striking historical results. The LEAPS-based approach showcased in Ravish’s July 2025 video claims a 96 percent win rate and roughly $180,000 in cumulative profit on QQQ over five years. Below is a beginner-friendly walkthrough recast as a narrative blog post rather than a checklist, so you can absorb the logic behind each step and apply it with confidence.

Why This Strategy Exists

The Nasdaq’s historical tendency to recover after short, sharp pullbacks underpins the logic. Ravish’s back-test shows that when QQQ gaps lower at the open yet remains in a broader up-trend, it often retraces the dip within a few months. By purchasing a slightly in-the-money 60-delta LEAPS call—effectively controlling stock but with predefined risk—you harness that rebound without micromanaging intraday noise.

Two Entry Signals, One Core Mechanism

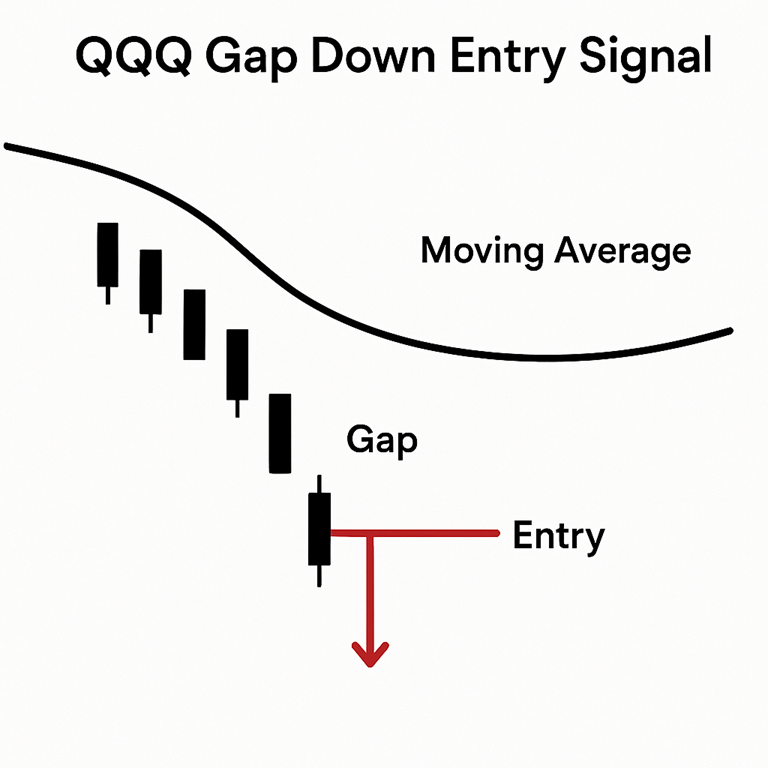

- The 1% Gap-Down + Trend Filter

Each morning, scan the pre-market quote. If QQQ opens at least one percent below the prior close and still trades above its 100-day simple moving average, the long-term up-trend remains intact. That alignment has produced 53 trades in five years with only two losers, generating about $88,400 in profit. - The 2% Capitulation Gap

A rarer yet stronger tailwind appears when QQQ gaps down two percent or more—regardless of its distance from the 100-day average. Because panic often exhausts itself in such large overnight moves, this trigger delivered $91,000 on just 27 trades, once again with a 96 percent win rate.

In both cases you buy a single (or, for the second setup, two) LEAPS call with roughly twelve months to expiry and a 0.60 delta—usually a strike just below the current market price.

Executing the Trade in Practice

Open your brokerage platform—Robinhood, Fidelity, Tastytrade, or any venue that supports long-dated options. Navigate to QQQ’s option chain, scroll to expirations at least a year out and locate the strike whose delta hovers near 0.60. Enter at the mid-price using a limit order; one contract keeps risk in check for smaller accounts.

Because this is a “set-and-forget” plan, no stop-loss is imposed. Instead, place an alert to exit once the option appreciates 50 percent. Historically that milestone arrived after about 102 days on average, freeing you to redeploy capital into the next qualified signal.

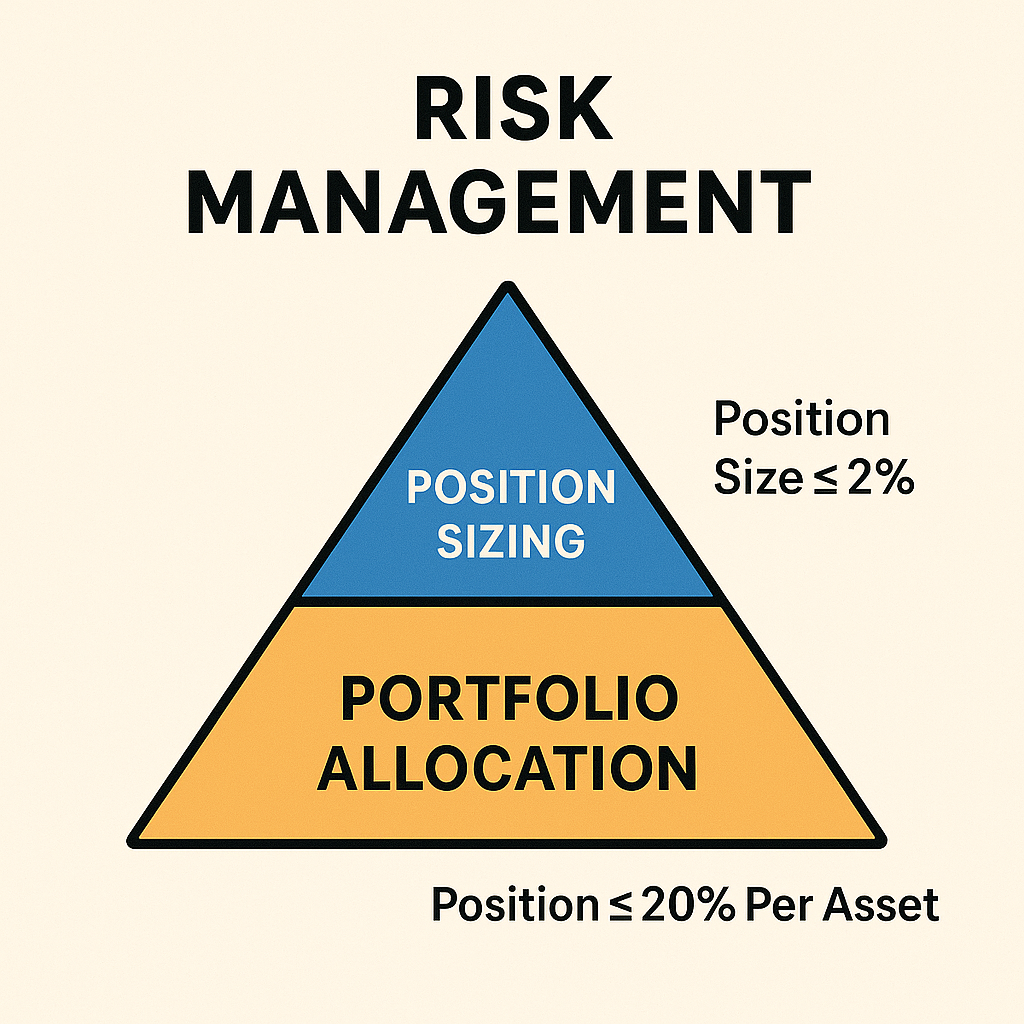

Risk Management Without Complexity

Even the most forgiving tactic can crater if position sizes mushroom. Cap exposure to two percent of account equity per trade and limit yourself to three open positions simultaneously. That guideline kept the strategy’s maximum drawdown between $6,000 and $9,300 during the 2022 bear stretch—roughly half of what straight buy-and-hold investors endured.

Performance Snapshot

| Metric (2019-2024) | Strategy 1 | Strategy 2 | Combined |

|---|---|---|---|

| Trades | 53 | 27 | 80 |

| Win rate | 96% | 96% | 96% |

| Total profit | $88,400 | $91,000 | $180,000 |

| Max drawdown | $9,300 | $6,000 | — |

These numbers emerge from a back-test, not a live account, yet they illustrate how infrequent but high-probability trades can compound when consistently executed.

Common Pitfalls to Dodge

New investors often sabotage themselves by oversizing positions, chasing signals outside the written rules or panicking during short-term volatility. Stick to the entry criteria, honor the 50 percent profit target and resist the urge to add discretionary tweaks until you have at least a year of firsthand data.

Final Thoughts

LEAPS offer a bridge between passive index exposure and hyper-active day-trading. By waiting for statistically favorable gap-downs and coupling them with generous time value, you position yourself for asymmetrical returns: limited downside (the premium paid) versus uncapped upside should the Nasdaq resume its climb. Combine disciplined position sizing with the patience to hold for weeks—not minutes—and you’ll have recreated the core engine behind Ravish’s 96 percent win-rate blueprint.

As always, past performance is no guarantee of future results. Use capital you can afford to risk, and consider paper-trading several signals before committing real funds. But if you crave a straightforward, low-maintenance path into options, the ultimate LEAPS strategy might be your on-ramp.

The information presented in this article is for educational purposes only and should not be considered financial advice. Investments carry significant risks, including the potential for total loss. Always conduct your own research and consult with qualified financial professionals before making investment decisions.