The cryptocurrency landscape is witnessing a seismic shift as companies increasingly pivot from Bitcoin to Ethereum for their treasury strategies. Following Michael Saylor’s groundbreaking Bitcoin accumulation model at Strategy (formerly MicroStrategy), a new cohort of publicly traded companies is now embracing Ethereum as their primary treasury asset. This strategic evolution represents more than just diversification—it’s a fundamental reimagining of how corporations can generate yield, participate in network security, and create long-term shareholder value through productive crypto assets.

The Ethereum Treasury Boom: Beyond Digital Gold

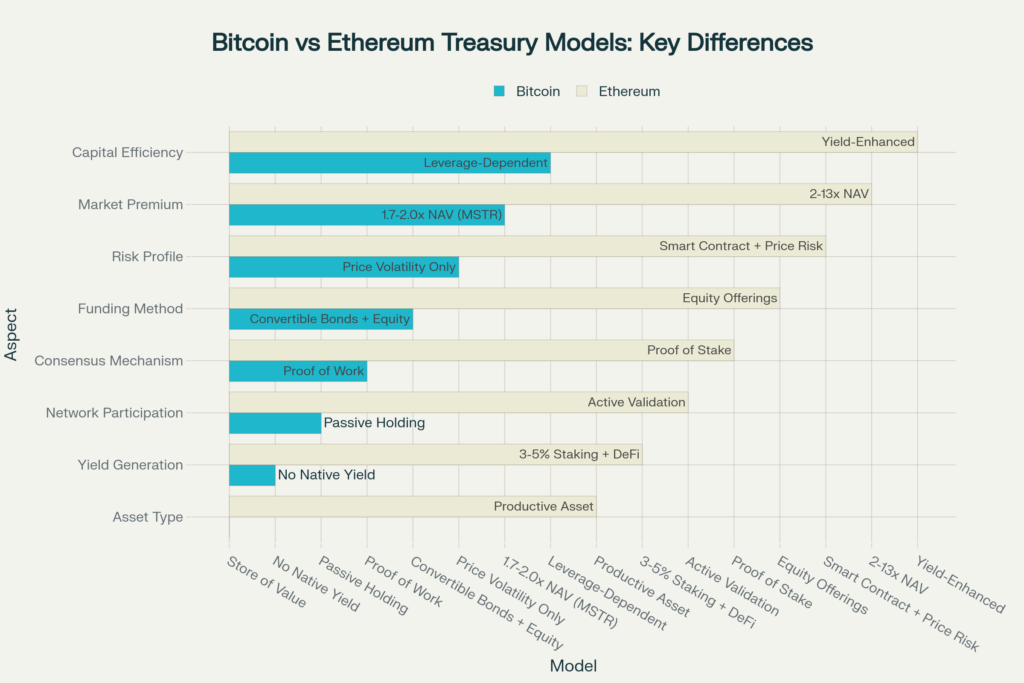

Unlike Bitcoin’s “digital gold” narrative, Ethereum treasury companies are pursuing a fundamentally different value proposition. Where Bitcoin treasury strategies rely primarily on price appreciation and leverage, Ethereum treasuries are designed as productive capital platforms that generate income through staking and decentralized finance (DeFi) participation.

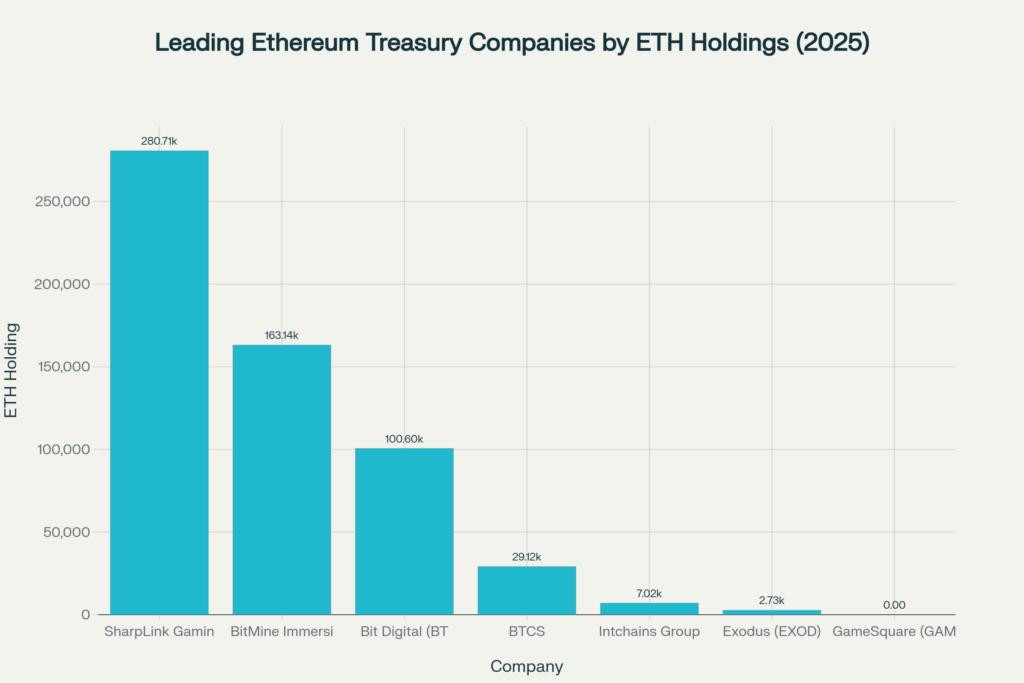

The numbers tell a compelling story. In the past 30 days alone, Ethereum treasury companies have accumulated over 545,000 ETH worth at least $1.6 billion. Leading this charge is SharpLink Gaming (SBET), which has become the world’s largest corporate holder of Ethereum with 280,706 ETH, surpassing even the Ethereum Foundation. Other major players include BitMine Immersion Technologies (BMNR) with 163,142 ETH and Bit Digital (BTBT) with over 100,000 ETH after completely pivoting from Bitcoin.

What sets these companies apart is their active participation in the Ethereum network. Rather than passive holding, they stake their ETH holdings to earn protocol-native rewards of 3-5% annually while simultaneously contributing to network security. SharpLink Gaming, for example, has staked 99% of its holdings and earned 322 ETH in staking rewards since launching its treasury strategy in June 2025.

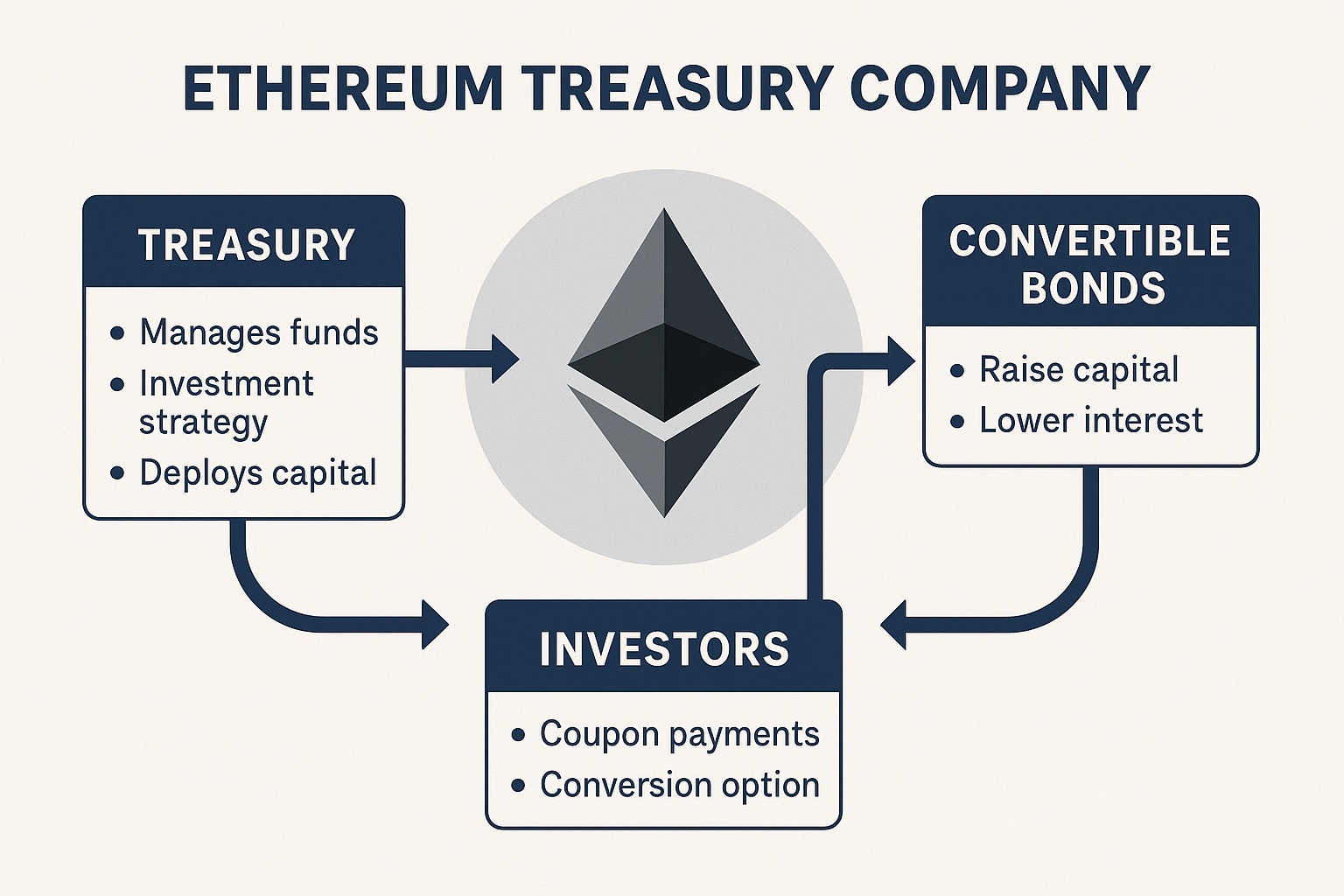

The Convertible Bond Mechanism: Engineering Shareholder Returns

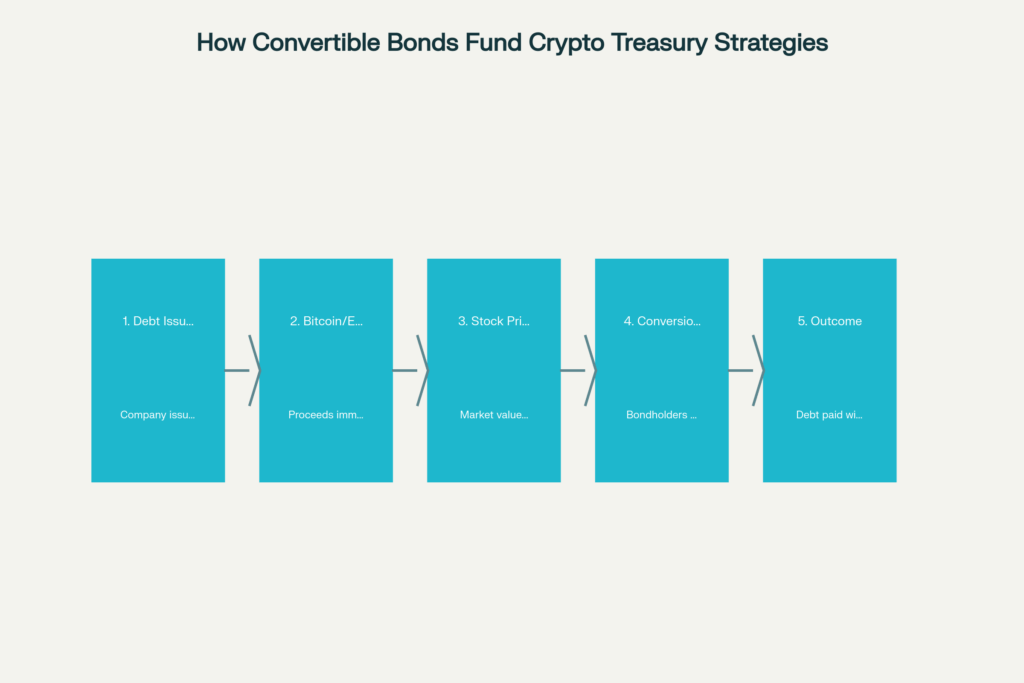

The financial architecture underlying these Ethereum treasury strategies closely mirrors the convertible bond playbook pioneered by Strategy, but with crucial enhancements that leverage Ethereum’s unique yield-generating properties.

The convertible bond mechanism works through a sophisticated five-step process that transforms cheap debt into leveraged crypto exposure. Companies issue zero-coupon or ultra-low interest convertible bonds to institutional investors, immediately deploying the proceeds to purchase Ethereum. The market typically responds by valuing the stock at a premium to its net asset value (NAV), creating what’s known as the mNAV premium.

This premium is crucial to the model’s sustainability. As long as the stock trades above NAV, companies can continue issuing equity to purchase more ETH without diluting shareholders’ per-share crypto exposure. The convertible structure provides bondholders with upside participation if the stock appreciates while offering companies access to capital at minimal interest rates—often zero percent.

Strategy has demonstrated the power of this approach, raising over $10 billion in just four months of 2025 through a combination of $6.6 billion in equity, $2.0 billion in convertible notes, and $1.4 billion in preferred equity. The company’s stock continues to trade at a significant premium to its Bitcoin NAV, enabling it to grow its holdings to over 600,000 BTC while maintaining shareholder value.

Ethereum’s Structural Advantages: Staking, Security, and Programmability

The shift toward Ethereum reflects several structural advantages that make it particularly attractive for corporate treasury strategies. Unlike Bitcoin, Ethereum operates on a proof-of-stake consensus mechanism that allows holders to earn yield by participating as validators or through liquid staking protocols.

Staking Economics and Network Security

Corporate treasury participation in Ethereum staking creates a virtuous cycle that benefits both companies and the broader network. With over 35 million ETH now staked—representing more than 30% of total supply—corporate participation is directly contributing to Ethereum’s security and decentralization. The more ETH held by corporate treasuries and actively staked, the more predictable and resilient Ethereum’s validator set becomes.

This network participation generates multiple revenue streams for treasury companies:

- Protocol rewards: 3-5% annual yields from validating transactions

- MEV (Maximal Extractable Value): Additional income from transaction ordering

- DeFi yields: Enhanced returns through liquidity provision and lending protocols

The US Stablecoin Law Impact

The recent passage of the GENIUS Act by President Trump has created additional tailwinds for Ethereum treasury strategies. The legislation establishes a comprehensive regulatory framework for US dollar-backed stablecoins, requiring them to be fully backed by liquid assets and mandating regular audits. Since the vast majority of stablecoins operate on Ethereum’s Layer 1 infrastructure, increased stablecoin adoption directly drives demand for ETH as gas fees and network utilization.

Standard Chartered Bank projects the stablecoin market could expand to $2 trillion by 2028 as a result of this regulatory clarity. This growth would require substantially more ETH to secure the network and process transactions, creating structural demand for the asset that corporate treasuries are now accumulating.

Shareholder Value Creation: Beyond Price Appreciation

Ethereum treasury companies are pioneering new approaches to shareholder value creation that go beyond simple price appreciation. The key differentiators include:

Active Yield Generation: Unlike Bitcoin treasuries that rely solely on price appreciation, Ethereum treasuries generate ongoing income through staking rewards, with some companies like GameSquare targeting 8-14% yields through sophisticated DeFi strategies.

Reduced Leverage Dependency: Most leading Ethereum treasury companies have funded their accumulation entirely through equity rather than debt, avoiding the refinancing risks and margin call pressures that can plague Bitcoin treasury models.

Enhanced Capital Efficiency: The ability to earn yield on holdings while maintaining upside exposure creates a more favorable risk-return profile compared to passive asset holding.

Network Alignment: By staking ETH, these companies align their interests with Ethereum’s long-term success, creating a structural incentive for protocol development and adoption.

Risk Management and Dilution Concerns

Despite the attractive yield characteristics, Ethereum treasury strategies face several risks that investors must carefully consider. The primary concerns include:

Dilution Risk: Companies that continue issuing equity near NAV risk diluting existing shareholders rather than creating value. VanEck’s research suggests companies should pause equity issuance if their stock trades below 0.95x NAV for extended periods.

Smart Contract Risk: DeFi strategies expose companies to smart contract vulnerabilities and protocol risks that don’t exist with simple asset holding.

Regulatory Uncertainty: While the stablecoin framework provides clarity, broader DeFi regulation remains uncertain, potentially impacting advanced yield strategies.

Market Volatility: Ethereum’s price volatility directly impacts treasury values, creating potential liquidity challenges during market downturns.

The Network Security Thesis

Perhaps the most compelling long-term argument for Ethereum treasury strategies lies in their contribution to network security. As Eric Conner, a veteran Ethereum core developer, notes, the ETH treasury strategy is creating a new paradigm where corporate capital directly strengthens the underlying infrastructure.

The math is striking: if just 1% of S&P 500 cash reserves ($22 trillion total) were allocated to ETH, it would represent 65 million ETH—more than half of the current total supply. This level of institutional participation would fundamentally alter Ethereum’s security model, creating what some analysts describe as a “Wall Street put” similar to the “sovereign put” that large Bitcoin holdings may enjoy.

Corporate staking participation also helps address one of Ethereum’s key challenges: validator set growth. The upcoming Pectra upgrade will increase the maximum effective balance per validator from 32 ETH to 2,048 ETH, allowing institutional stakers to consolidate operations while maintaining network decentralization.

Investment Considerations and Portfolio Allocation

For retail investors and crypto enthusiasts evaluating exposure to Ethereum treasury companies, several key factors warrant consideration:

Premium Sustainability: Companies trading at high multiples to NAV face pressure to demonstrate consistent execution and growth in ETH per share. Investors should monitor mNAV ratios and dilution metrics closely.

Capital Allocation Discipline: The most successful treasury companies maintain transparent capital structures and conservative dilution practices. Equity-funded strategies generally offer better risk profiles than highly leveraged approaches.

Yield Strategy Sophistication: Companies pursuing advanced DeFi strategies may offer higher returns but also carry additional operational and smart contract risks.

Network Participation: Active staking and validator operation demonstrate genuine commitment to the Ethereum ecosystem beyond speculative positioning.

Future Outlook: Convergence of Traditional and Decentralized Finance

The emergence of Ethereum treasury companies represents a broader convergence between traditional corporate finance and decentralized protocols. As institutional adoption accelerates and regulatory frameworks mature, these strategies are likely to become increasingly sophisticated and mainstream.

The integration of staking yields with traditional capital market instruments creates new possibilities for financial engineering that blur the lines between debt, equity, and crypto assets. Companies are already experimenting with tokenized shares, staked asset collateralization, and cross-chain treasury strategies that leverage Ethereum’s programmable infrastructure.

For the Ethereum network itself, corporate treasury participation provides a stabilizing force that could help smooth the path toward greater scalability and mainstream adoption. As more institutional capital commits to long-term staking, the network benefits from increased predictability and reduced selling pressure during market volatility.

The Productive Treasury Revolution

The shift from Bitcoin to Ethereum treasury strategies marks a fundamental evolution in how corporations think about reserve assets. Rather than passive stores of value, these companies are building productive treasury platforms that generate yield, enhance network security, and create new forms of shareholder value.

While risks remain—particularly around dilution, smart contracts, and regulatory uncertainty—the structural advantages of Ethereum’s staking mechanism and programmable infrastructure offer compelling opportunities for disciplined capital allocation. As the US stablecoin framework drives increased network utilization and corporate staking participation continues to grow, Ethereum treasury companies are positioned to benefit from both technological adoption and financial innovation.

For investors, the key lies in identifying companies with sustainable mNAV premiums, disciplined capital allocation practices, and genuine commitment to the Ethereum ecosystem’s long-term success. The companies that can balance these factors while executing sophisticated yield strategies may well define the next chapter of corporate cryptocurrency adoption.

The Ethereum treasury revolution is just beginning, and its ultimate impact on both corporate finance and decentralized networks promises to be transformational. As traditional and decentralized finance continue to converge, these pioneering treasury strategies offer a glimpse into a future where corporate balance sheets actively participate in securing and strengthening the financial infrastructure of the digital economy.

The information presented in this article is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risks, including the potential for total loss. Always conduct your own research and consult with qualified financial professionals before making investment decisions.