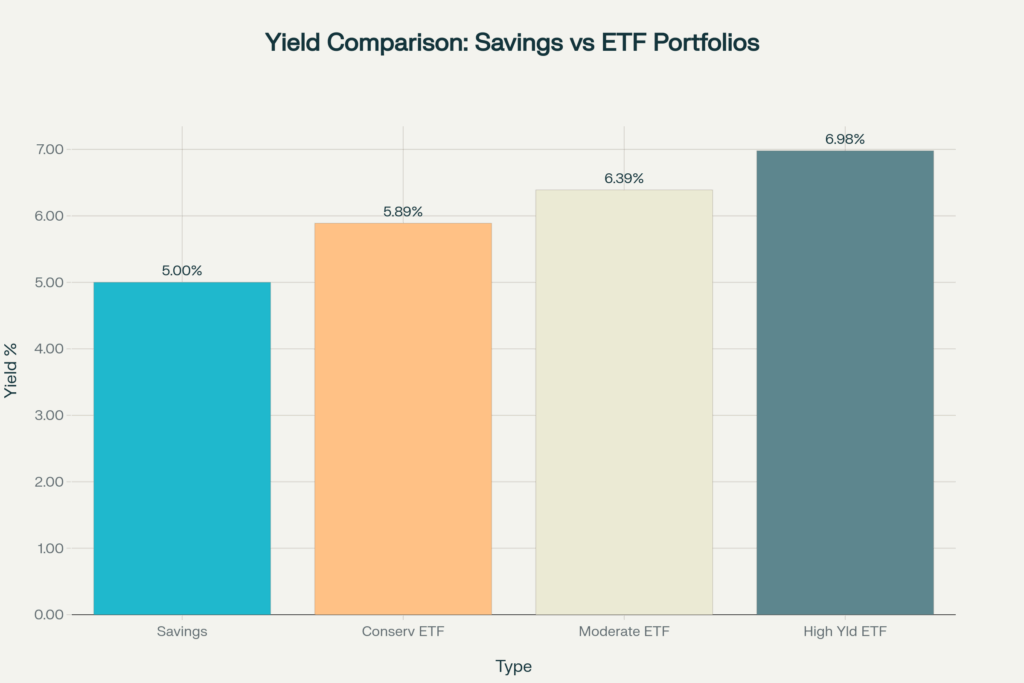

The current interest rate environment presents unique opportunities for conservative investors seeking higher returns without significantly increasing risk. While high-yield savings accounts offer rates up to 5.00% APY as of July 2025, strategically constructed ETF portfolios can deliver 6-7% yields with only modest additional risk. This comprehensive analysis examines how short-duration high-yield bond ETFs and CLO (Collateralized Loan Obligation) funds can provide superior returns while maintaining conservative risk profiles.

Understanding the Current Market Landscape

High-yield savings accounts currently offer competitive rates, with top providers like Varo Bank, AdelFi, and Fitness Bank offering 5.00% APY. However, these rates remain variable and will likely decline as the Federal Reserve continues its anticipated rate-cutting cycle. The Fed’s latest projections suggest only two quarter-point cuts in 2025, bringing rates to 3.75%-4.00%, but savings rates typically follow Fed changes closely.

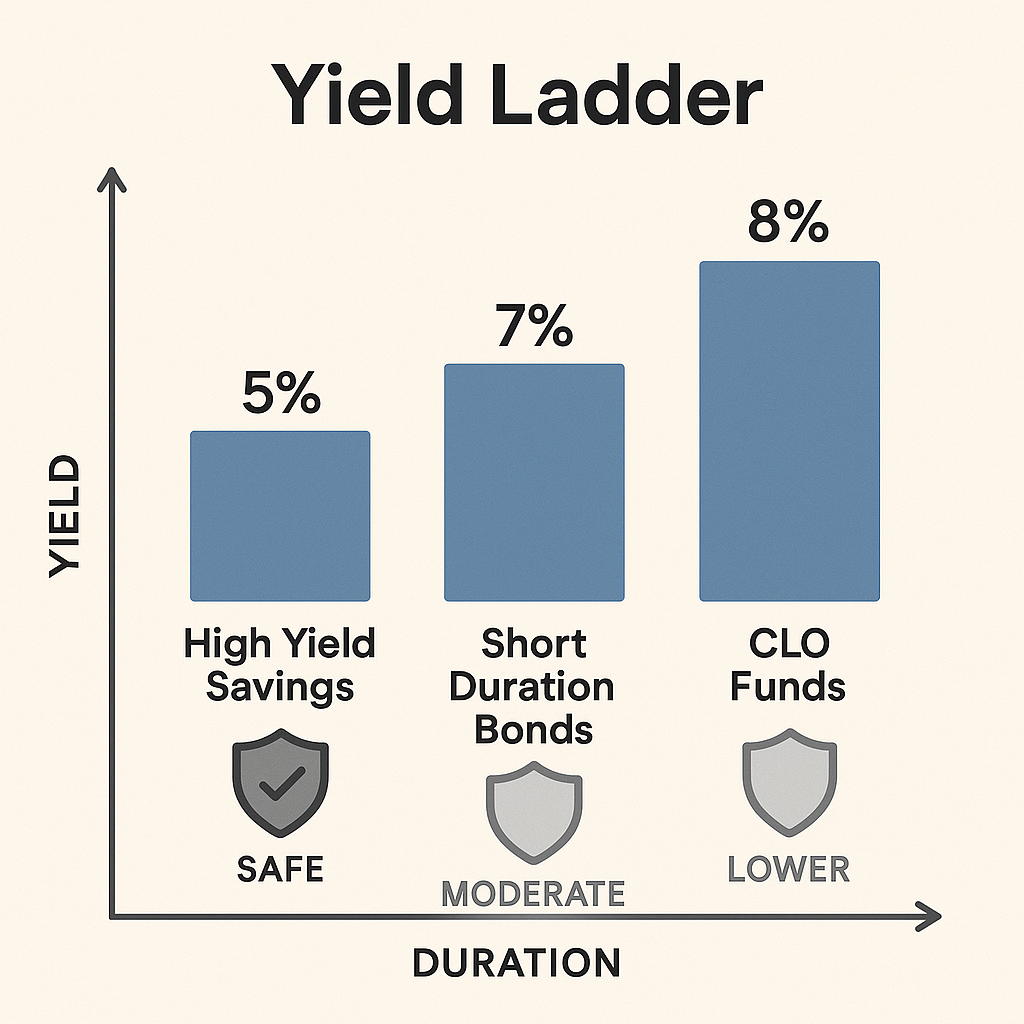

In contrast, certain ETF categories can lock in higher yields for extended periods while maintaining low risk profiles. Short-duration high-yield corporate bond ETFs currently yield between 6.87% and 7.43%, while high-quality CLO ETFs offer yields of 5.32% to 8.80%. These instruments provide yield advantages of 1.5-3.0 percentage points over savings accounts.

The Science of Short-Duration High-Yield Bond ETFs

Short-duration high-yield bond ETFs represent the sweet spot between yield and risk management. These funds invest in corporate bonds with maturities typically under five years, dramatically reducing interest rate sensitivity while maintaining credit quality through diversification.

Research demonstrates that short-duration high-yield strategies have historically delivered superior risk-adjusted returns. For 2024, short-duration high-yield returned 7.1%, significantly outperforming core bonds (1.3%) and investment-grade corporate bonds (2.8%). The key advantage lies in their limited duration exposure – typically 2-3 years compared to 6-8 years for traditional high-yield funds.

The iShares 0-5 Year High Yield Corporate Bond ETF (SHYG) exemplifies this strategy, with a current SEC yield of 6.87% and modified duration of just 2.43 years. The fund’s diversification across 1,175 holdings provides substantial protection against single-issuer defaults while maintaining attractive yields. Similarly, the SPDR Short Term High Yield Bond ETF (SJNK) offers 7.30% yield with 2.07 years duration.

CLO ETFs: The Hidden Gem of Conservative Fixed Income

Collateralized Loan Obligations represent one of the most compelling opportunities in fixed income markets. CLOs are structured securities backed by portfolios of senior secured loans, offering unique risk-return characteristics that traditional bond investors often overlook.

AAA-rated CLO tranches have never experienced a default in modern history, yet they offer yields significantly above similarly rated corporate bonds. The structural protections built into CLOs – including overcollateralization, coverage tests, and subordination – create multiple layers of credit protection. Academic research confirms that CLO debt tranches offer high yields relative to corporate bonds with similar ratings and duration, though they don’t provide abnormal risk-adjusted returns after accounting for systematic risk factors.

Current CLO ETF yields demonstrate this advantage clearly. The Janus Henderson AAA CLO ETF (JAAA) yields 5.32% with ultra-low 0.1-year duration, while the VanEck CLO ETF (CLOI) offers 5.69% yield. For investors willing to accept slightly higher risk, the Panagram BBB-B CLO ETF (CLOZ) provides 8.80% yield, significantly outperforming traditional high-yield bonds.

Portfolio Construction Strategies

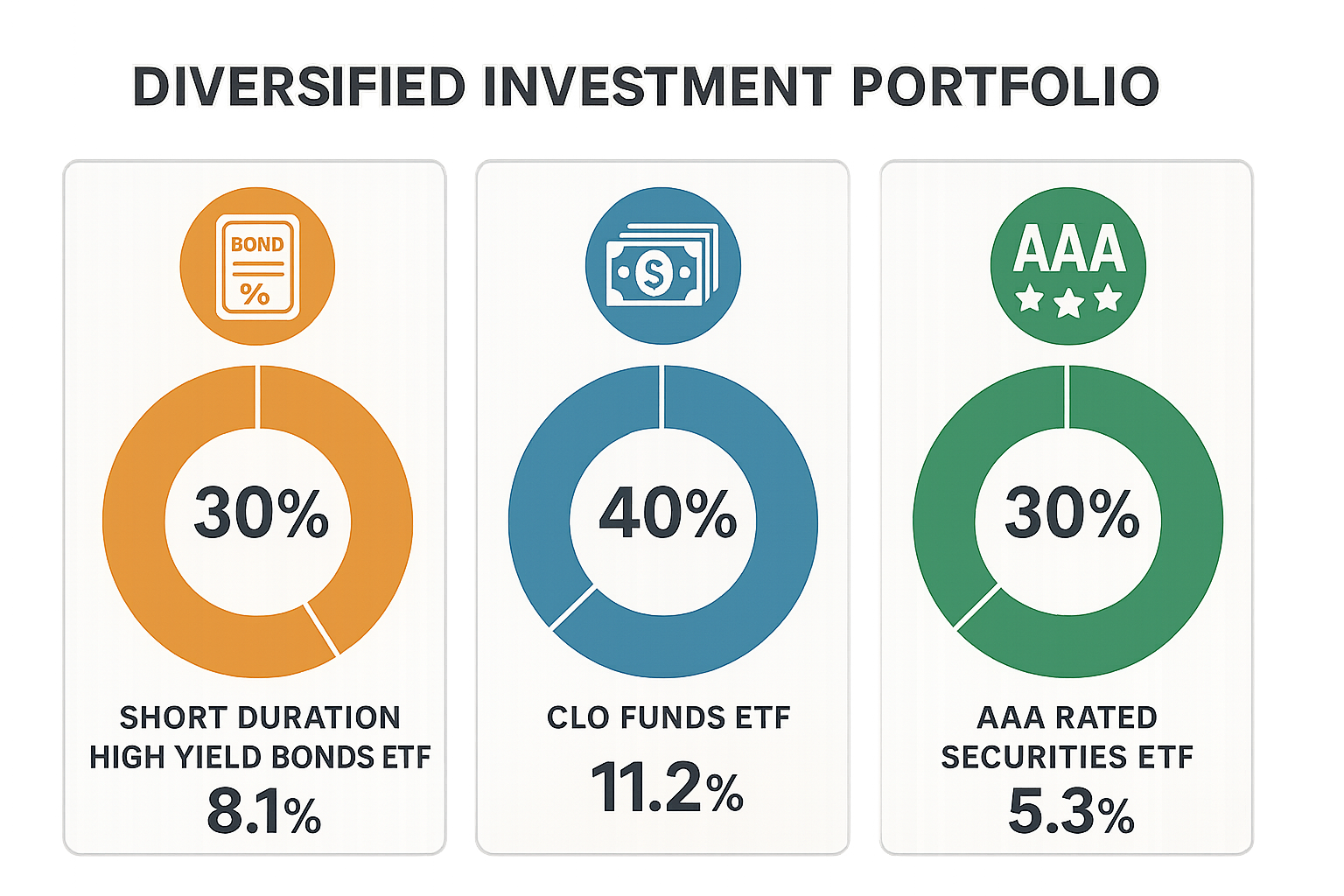

Based on extensive research and current market conditions, three distinct portfolio strategies emerge, each tailored to different risk tolerances and return objectives.

Conservative Strategy (5.89% Net Yield)

This approach prioritizes capital preservation while enhancing yield. The allocation combines 30% JAAA, 30% CLOA, 25% SHYG, and 15% SJNK, resulting in an average duration of just 0.98 years. This strategy delivers 89 basis points of additional yield over top savings accounts while maintaining minimal interest rate risk.

Moderate Strategy (6.39% Net Yield)

The moderate approach balances yield enhancement with controlled risk through equal 25% allocations to SHYG, SJNK, PSH, and JAAA. This portfolio achieves 1.39 percentage points of additional yield over savings accounts with 1.70 years average duration. The diversification across short-duration high-yield and AAA CLO exposures provides optimal risk-adjusted returns.

Higher Yield Strategy (6.98% Net Yield)

For investors comfortable with modest additional risk, this strategy allocates 30% to JBBB, 30% to SJNK, 25% to PSH, and 15% to JAAA. The portfolio delivers nearly 2.0 percentage points of additional yield while maintaining 1.25 years average duration. The higher allocation to BBB-rated CLO tranches drives the enhanced returns.

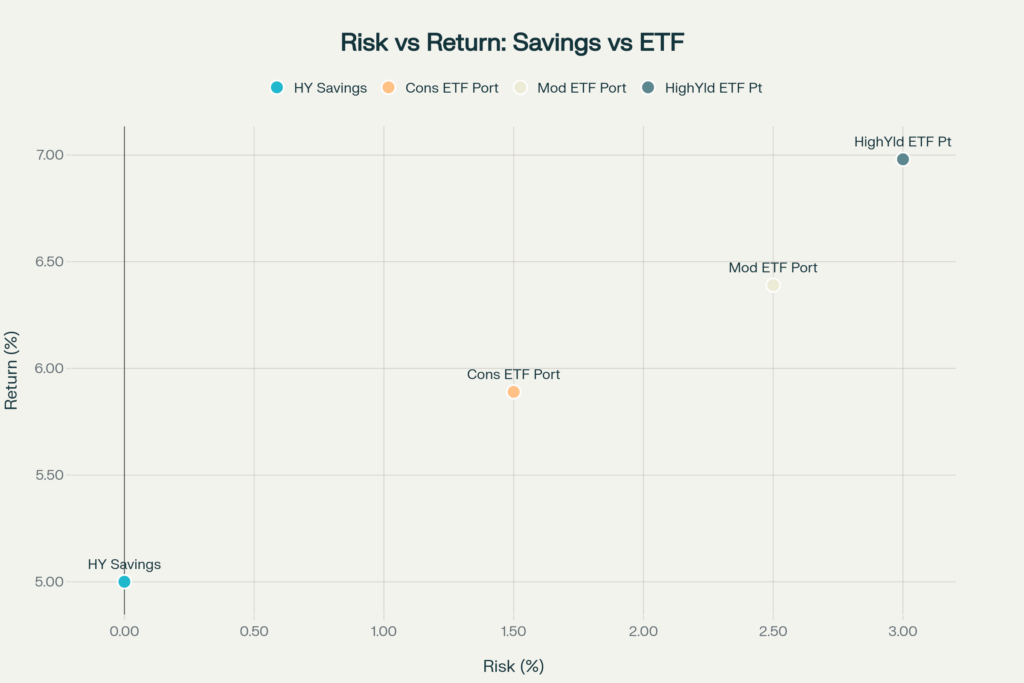

Risk Analysis and Drawdown Considerations

Historical analysis of bond ETF drawdowns reveals that short-duration strategies significantly outperform longer-duration alternatives during periods of market stress. The Vanguard Total Bond Market Index Fund (BND) experienced an 18.58% maximum drawdown over the past five years, while long-duration Treasury ETFs like TLT suffered 48% losses from peak to trough.

In contrast, short-duration high-yield ETFs typically experience maximum drawdowns of 2-5% during market stress periods. CLO ETFs demonstrate even greater stability, with AAA-rated tranches showing maximum drawdowns under 2% historically. This resilience stems from their floating-rate structure, which provides natural hedging against interest rate changes.

Academic research on drawdown risk confirms that short-duration strategies provide superior downside protection. Studies show that funds with shorter durations face significantly lower risk from rate hikes while maintaining the potential for price appreciation when rates decline. The floating-rate nature of CLOs provides additional protection, as their coupons reset quarterly with prevailing rates.

Federal Reserve Policy Implications

The Federal Reserve’s current monetary policy stance supports the ETF strategy thesis. With the Fed funds rate held at 4.25%-4.50% and only modest cuts expected in 2025, the environment remains favorable for floating-rate and short-duration instruments. Fed officials project inflation to remain above their 2% target through 2026, suggesting a cautious approach to rate cuts.

This “higher for longer” environment particularly benefits CLO ETFs, which capture the full benefit of elevated base rates through their floating-rate structure. As VanEck research demonstrates, CLOs have historically outperformed in rising rate environments, with the recent period from August 2020 to October 2022 showing significant outperformance relative to fixed-rate bonds.

Comparative Performance Analysis

Recent performance data strongly supports the ETF approach over traditional savings strategies. Short-duration high-yield ETFs delivered 7.1% returns in 2024, while money market funds and savings accounts provided returns well below 5%. The yield advantage has persisted even as the Fed began cutting rates, with CLO ETFs continuing to deliver positive returns for 21 consecutive months through 2024.

The performance differential reflects fundamental structural advantages. ETF portfolios benefit from professional management, diversification across hundreds of issuers, and the ability to capture credit spread tightening. In contrast, savings accounts offer limited upside potential and face immediate rate compression when the Fed cuts rates.

Liquidity and Accessibility Considerations

Modern ETF structures provide significant advantages over traditional fixed income investments. High-yield and CLO ETFs trade on major exchanges with tight bid-ask spreads, typically 0.05-0.15% for major funds. This liquidity advantage allows investors to access their capital quickly without the delays or penalties associated with CDs or structured products.

The transparency of ETF holdings, disclosed daily, provides investors with complete visibility into their investments. This contrasts with traditional bond funds that may disclose holdings monthly or quarterly. Additionally, ETF tax efficiency through in-kind redemptions provides superior after-tax returns compared to traditional mutual funds.

Implementation Best Practices

Successful implementation requires attention to several key factors. First, investors should focus on ETFs with substantial assets under management and established track records. Funds like SHYG ($6.81 billion AUM) and JAAA provide adequate liquidity and operational efficiency.

Second, expense ratios matter significantly over time. The research identifies funds with expense ratios ranging from 0.20% to 0.49%, with lower-cost options like JAAA (0.21%) and CLOA (0.20%) providing better net returns. The impact of expenses on long-term returns justifies careful attention to fee structures.

Third, portfolio rebalancing should occur quarterly to maintain target allocations and capture any tactical opportunities. The dynamic nature of credit markets and interest rate changes requires active oversight rather than passive buy-and-hold strategies.

What More Do You Need?

The research conclusively demonstrates that strategically constructed ETF portfolios can safely deliver 6-7% yields while maintaining conservative risk profiles. The combination of short-duration high-yield corporate bonds and high-quality CLO tranches provides superior returns to high-yield savings accounts with only modest additional risk.

Current market conditions strongly favor this approach, with elevated base rates, supportive Federal Reserve policy, and attractive credit spreads creating an optimal environment for conservative yield enhancement. The historical performance data, combined with structural advantages of modern ETF investing, supports a strategic allocation to these instruments for investors seeking to optimize their fixed income returns.

For conservative investors willing to accept minimal additional risk, the moderate strategy delivering 6.39% net yield represents an optimal balance of return enhancement and capital preservation. This approach provides nearly 1.4 percentage points of additional annual return while maintaining professional management, daily liquidity, and transparent operations that high-yield savings accounts cannot match.

The information presented in this article is for educational purposes only and should not be considered financial advice. Investments carry significant risks, including the potential for total loss. Always conduct your own research and consult with qualified financial professionals before making investment decisions.