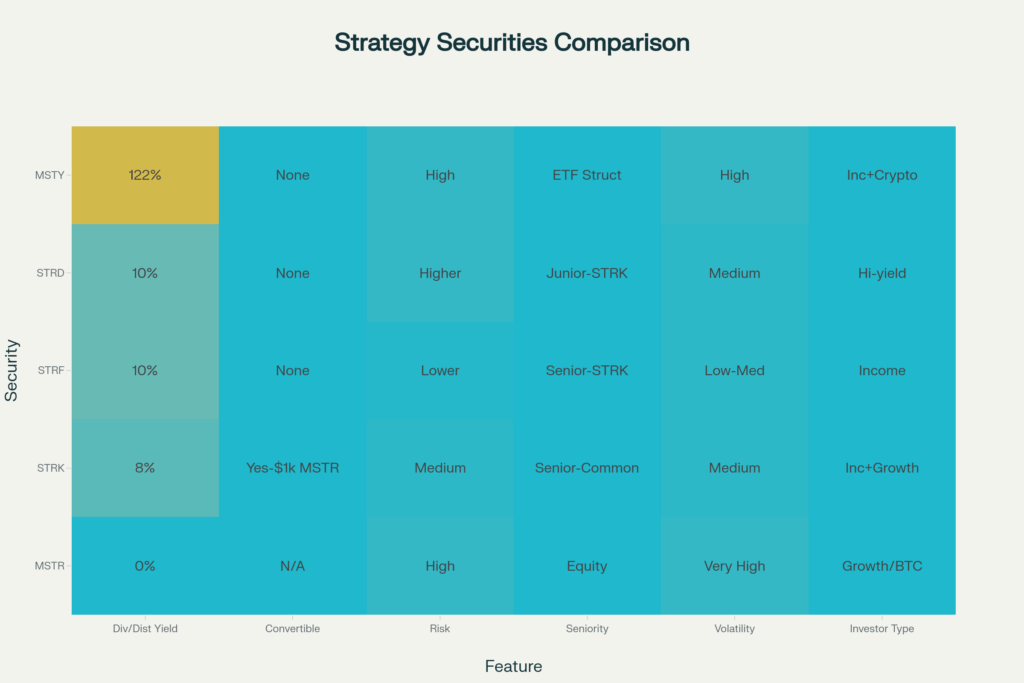

The cryptocurrency landscape has undergone a seismic transformation, with institutional adoption reaching unprecedented levels and Bitcoin establishing itself as a legitimate treasury asset. At the epicenter of this revolution stands Strategy Incorporated (formerly MicroStrategy), which has evolved from a traditional business intelligence software company into the world’s largest corporate Bitcoin treasury firm. This comprehensive analysis examines Strategy’s innovative multi-tiered investment ecosystem, encompassing its common stock (MSTR), preferred securities (STRK, STRF, STRD), and the popular YieldMax covered call ETF (MSTY) – another play on Strategy’s volatility profile to drive options income, providing investors with a roadmap for navigating this complex but potentially rewarding investment universe.

Strategy has pioneered a revolutionary approach to Bitcoin exposure through its diversified securities offerings, creating what Executive Chairman Michael Saylor describes as a “Bitcoin treasury engine”. With over 601,550 bitcoins worth approximately $72.47 billion on its balance sheet, Strategy has transformed from a $3 billion software company into a $126.7 billion Bitcoin proxy. The company’s market capitalization now trades at a 74.9% premium to its Bitcoin holdings, reflecting investors’ confidence in its ability to continue accumulating the cryptocurrency through innovative financial engineering.

The investment universe Strategy has created offers something for every type of investor: from conservative income seekers to aggressive growth investors. This analysis reveals that while MSTR common stock delivered an extraordinary 558.23% return over 18 months, the preferred securities and ETF strategies provide more nuanced risk-reward profiles suitable for different investment objectives.

Understanding Strategy’s Bitcoin Treasury Strategy

The Core Business Model

Strategy’s business model represents a paradigm shift in corporate finance, where traditional software revenues ($463.46 million annually) serve as a foundation for a much larger Bitcoin accumulation strategy. The company leverages multiple financing vehicles—equity offerings, convertible debt, and preferred securities—to continuously acquire Bitcoin, betting that the cryptocurrency’s long-term appreciation will far exceed the cost of capital.

This strategy has proven remarkably successful. Since beginning its Bitcoin purchases in August 2020, Strategy has achieved an average cost basis of $71,269 per Bitcoin, with current holdings valued at approximately $72.47 billion. The company’s “Bitcoin yield” metric, which measures the increase in Bitcoin per share over time, has become a key performance indicator that differentiates it from traditional investment vehicles.

The “Infinite Money Glitch” Phenomenon

Saylor’s characterization of Strategy’s model as an “infinite money glitch” reflects the self-reinforcing nature of the strategy. As Bitcoin appreciates, Strategy’s stock price increases, enabling the company to issue new shares at higher valuations to purchase more Bitcoin, which theoretically drives further price appreciation. This flywheel effect has created a leveraged exposure to Bitcoin that often exceeds 2.5x the underlying cryptocurrency’s movements.

However, this model also introduces significant risks. The strategy depends on continued access to capital markets, sustained Bitcoin appreciation, and the maintenance of the premium investors are willing to pay for Strategy’s shares over their net asset value. During periods of Bitcoin weakness or market stress, this premium can compress rapidly, as evidenced by the stock’s high beta of 3.71.

Comprehensive Analysis of Strategy’s Investment Universe

MSTR: The Pure Bitcoin Play

Strategy’s common stock (MSTR) represents the purest expression of the company’s Bitcoin thesis. Trading at $451.02 as of July 2025, MSTR has delivered exceptional returns for investors willing to accept high volatility. The stock’s performance closely tracks Bitcoin’s price movements but with significant amplification—both on the upside and downside.

Performance Metrics:

- 18-month total return: 558.23%

- 2024 return: 322.68%

- 2025 YTD return: 50.33%

- All-time high: $543.00 (November 2024)

- Current beta: 3.71 (indicating extreme volatility)

MSTR is most suitable for investors who:

- Have a strong conviction in Bitcoin’s long-term prospects

- Can tolerate extreme volatility (daily swings of 10-20% are common)

- Prefer exposure through traditional equity markets rather than direct cryptocurrency ownership

- Are comfortable with the premium valuation Strategy commands over its Bitcoin holdings

The stock’s volatility makes it challenging for income-focused investors or those with shorter investment horizons. However, for aggressive growth investors with a multi-year outlook, MSTR offers unparalleled leverage to Bitcoin’s potential appreciation.

STRK: The Convertible Income Play

The Series A Perpetual Strike Preferred Stock (STRK) represents Strategy’s first foray into creating a hybrid security that combines income generation with upside potential. Launched in February 2025, STRK offers an 8% annual dividend while maintaining a conversion feature that allows holders to exchange their shares for MSTR common stock when certain conditions are met.

Key Features:

- 8% fixed annual dividend ($2.00 quarterly on $100 liquidation preference)

- Convertible to 0.1 shares of MSTR when MSTR trades at or above $1,000

- Currently trading at approximately $87.45, providing an effective yield of ~9.1%

- Perpetual structure with no maturity date

STRK’s convertibility feature creates an asymmetric risk-reward profile. If MSTR remains below $1,000, investors receive steady dividend income with lower volatility than the common stock. If MSTR appreciates significantly, the conversion option provides substantial upside participation.

The security has demonstrated its defensive characteristics during market volatility. Since its launch, STRK has risen 3% while MSTR declined over 20% during the same period, highlighting its lower correlation to Bitcoin price movements.

Investment Considerations:

- Suitable for investors seeking income with potential upside

- Lower volatility than MSTR (49% vs. >100%)

- Correlation of only 26% with MSTR and -7% with Bitcoin

- Dividend payments depend on Strategy’s board declarations

STRF: The Conservative Income Option

The Series A Perpetual Strife Preferred Stock (STRF) was designed for investors prioritizing stable income over growth potential. Offering a 10% annual dividend with cumulative features, STRF provides the highest level of downside protection among Strategy’s securities.

Key Features:

- 10% fixed annual dividend with cumulative provisions

- No conversion feature—pure income play

- Senior to both STRK and STRD in the capital structure

- Dividend rate can escalate to 18% if payments are missed

- Currently trading at approximately $118.51

STRF’s cumulative dividend structure means that if Strategy fails to pay dividends, the unpaid amounts accumulate at an additional 1% per year, creating strong incentives for timely payments. This feature provides additional protection for income-focused investors.

The security appeals to:

- Conservative investors seeking steady income

- Those prioritizing capital preservation over growth

- Investors who want Bitcoin exposure without direct volatility

- Income-focused portfolios requiring predictable cash flows

STRD: The High-Yield Opportunity

The Series A Perpetual Stride Preferred Stock (STRD) represents Strategy’s most recent innovation, designed to capture demand from yield-seeking investors willing to accept higher risk for potentially higher returns. Launched in June 2025, STRD offers a 10% dividend but with important structural differences from STRF.

Key Features:

- 10% annual dividend (non-cumulative)

- No conversion feature

- Junior to both STRF and STRK in the capital structure

- Non-mandatory dividend payments

- Currently trading at approximately $93.94

STRD’s non-cumulative structure means that if Strategy skips dividend payments, investors have no claim to those missed payments in the future. This creates higher risk but potentially higher returns for investors willing to accept this uncertainty.

The security has generated controversy among some investors who view it as evidence of Strategy’s increasing capital needs. However, proponents argue that it provides an additional tool for the company to raise capital during favorable market conditions while offering investors a high-yield alternative.

MSTY: The Covered Call Strategy

The YieldMax MSTR Option Income Strategy ETF (MSTY) represents a unique approach to generating income from Strategy’s volatility through sophisticated options strategies. Launched in February 2024, MSTY has rapidly grown to over $5.7 billion in assets under management, demonstrating strong investor demand for yield-generating Bitcoin exposure.

Strategy Overview:

- Uses synthetic covered call strategies on MSTR

- Sells call options 0%-15% out of the money monthly

- Generates income through option premiums

- Caps upside potential in exchange for regular distributions

Performance Metrics:

- Current distribution yield: approximately 122%

- Monthly distribution payments

- Assets under management: $5.7 billion

- Significant premium capture during volatile periods

MSTY’s appeal lies in its ability to monetize MSTR’s extreme volatility through systematic option writing. The strategy works best in range-bound or moderately bullish markets where MSTR’s price appreciation doesn’t exceed the option strike prices.

Risk Considerations:

- High volatility despite income focus

- Potential for significant underperformance during strong Bitcoin rallies

- Complex structure may not be suitable for all investors

- Distribution sustainability depends on continued MSTR volatility

Strategy’s Investment Universe: A Comprehensive Comparison of MSTR, Preferred Securities, and MSTY ETF

Market Outlook and Strategic Positioning

Bitcoin Price Forecasts and Institutional Adoption

The cryptocurrency market enters the second half of 2025 with unprecedented institutional momentum. Multiple forecasts suggest Bitcoin could reach $150,000-$175,000 by year-end, driven by continued ETF inflows, corporate adoption, and potential regulatory clarity. Conservative estimates project Bitcoin trading in the $125,000-$130,000 range, while more bullish scenarios anticipate prices reaching $180,000 or higher.

Several factors support these optimistic projections:

- Institutional Demand: Over 30% of Bitcoin’s circulating supply is now held by centralized entities, including ETFs, corporations, and sovereigns. Consulting firm UTXO Management projects an additional $120 billion in institutional flows before year-end 2025.

- ETF Growth: U.S. spot Bitcoin ETFs have accumulated over $143 billion in assets under management, with institutional participation growing rapidly. Professional investors now hold over $27.4 billion worth of Bitcoin ETFs, representing 26.3% of total ETF assets.

- Corporate Adoption: The “Bitcoin treasury” strategy pioneered by Strategy is being adopted by other companies. Trump Media & Technology Group and GameStop have announced plans to follow similar playbooks.

- Regulatory Clarity: The changing regulatory environment, particularly in the U.S., is creating more favorable conditions for cryptocurrency adoption. The potential passage of the CLARITY Act could provide additional regulatory certainty.

Strategy’s Competitive Advantages

Strategy’s first-mover advantage in corporate Bitcoin adoption has created several sustainable competitive advantages:

- Scale and Expertise: With over 601,550 bitcoins, Strategy has developed sophisticated systems for Bitcoin acquisition, custody, and management that would be difficult for competitors to replicate quickly.

- Capital Market Access: The company’s proven ability to raise capital through multiple instruments gives it flexibility to continue accumulating Bitcoin across market cycles.

- Financial Engineering Innovation: Strategy’s creation of preferred securities and convertible instruments has established templates that other companies may struggle to replicate without similar market credibility.

- Brand Recognition: The company’s association with Bitcoin and Michael Saylor’s evangelism has created strong brand recognition in the cryptocurrency space.

Long-Term Forecast and Investment Implications

Looking toward 2026-2030, several scenarios emerge for Strategy’s investment universe:

Base Case Scenario (Bitcoin at $150,000-$200,000):

- MSTR could trade between $600-$800, assuming current premium structure

- STRK conversion feature becomes increasingly valuable as MSTR approaches $1,000

- Preferred securities maintain steady dividend payments

- MSTY continues generating attractive yields from volatility

Bullish Scenario (Bitcoin at $200,000-$250,000):

- MSTR could exceed $1,000, triggering STRK conversions

- Strategy’s Bitcoin holdings could exceed $150 billion in value

- Premium compression possible as Bitcoin becomes more mainstream

- Preferred securities may face redemption pressure

Bearish Scenario (Bitcoin at $80,000-$100,000):

- MSTR could decline to $200-$300 range

- Preferred securities provide downside protection

- MSTY distributions may decline with reduced volatility

- Strategy may face pressure to reduce Bitcoin acquisition pace

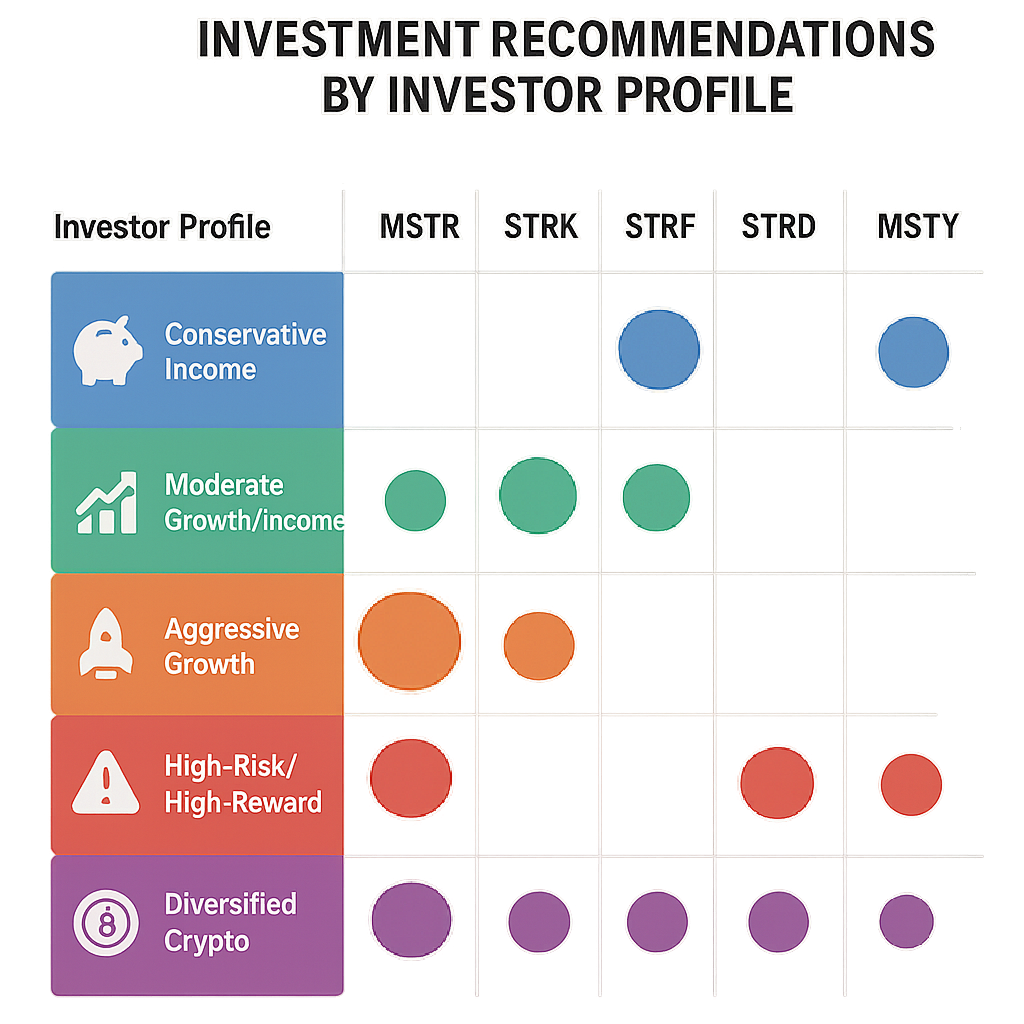

Investment Recommendations by Investor Profile

Conservative Income Investors

Recommended Allocation: STRF (60%) + MSTY (40%)

Conservative investors seeking steady income with indirect Bitcoin exposure should prioritize STRF’s cumulative dividend structure and senior position in the capital structure. The 10% dividend provides attractive yield in the current interest rate environment, while the cumulative feature offers protection against missed payments.

MSTY’s inclusion provides additional income diversification through its covered call strategy, though investors should be prepared for higher volatility than traditional income investments. The combination offers an expected yield of 8-10% with moderate Bitcoin exposure.

Key Considerations:

- Monitor Strategy’s cash flow generation for dividend sustainability

- Consider position sizing relative to overall portfolio risk tolerance

- Understand that both securities carry cryptocurrency-related risks

Moderate Growth/Income Investors

Recommended Allocation: STRK (50%) + STRF (30%) + MSTR (20%)

Investors seeking a balance between current income and growth potential should emphasize STRK’s convertible feature while maintaining defensive positions in STRF. The 8% dividend from STRK provides steady income, while the conversion option offers significant upside if MSTR reaches $1,000.

A small allocation to MSTR provides direct participation in Bitcoin’s potential appreciation while the preferred securities offer downside protection. This combination targets 6-8% yield plus upside participation.

Key Considerations:

- Monitor MSTR’s progression toward $1,000 conversion level

- Rebalance periodically to maintain target allocations

- Consider tax implications of potential STRK conversions

Aggressive Growth Investors

Recommended Allocation: MSTR (70%) + STRK (30%)

Growth-focused investors with high risk tolerance should emphasize MSTR’s leverage to Bitcoin price movements while using STRK to provide some income and downside protection. This allocation maximizes upside potential while maintaining some defensive characteristics.

The STRK position provides optionality—if Bitcoin enters a prolonged bear market, the dividend payments offer some compensation, while the conversion feature ensures full participation in any dramatic upside.

Key Considerations:

- Prepare for extreme volatility and potential drawdowns

- Consider dollar-cost averaging during market volatility

- Monitor Bitcoin’s technical and fundamental developments closely

High-Risk/High-Reward Investors

Recommended Allocation: MSTR (50%) + STRD (30%) + MSTY (20%)

Investors comfortable with significant risk in pursuit of exceptional returns should emphasize MSTR’s growth potential while using STRD’s high yield to generate current income. MSTY’s covered call strategy provides additional income diversification.

This allocation targets 8-12% yield plus high growth potential, though it carries the highest risk of the recommended strategies. The non-cumulative nature of STRD’s dividends adds risk but potentially higher returns.

Key Considerations:

- Monitor Strategy’s capital allocation decisions closely

- Be prepared for significant volatility across all positions

- Consider using options strategies to hedge downside risk

Diversified Crypto Investors

Recommended Allocation: MSTR (40%) + STRK (25%) + STRF (20%) + MSTY (15%)

Investors seeking comprehensive exposure to Strategy’s ecosystem should maintain positions across all major instruments. This approach provides balanced exposure to growth, income, and options strategies while diversifying specific security risks.

The allocation targets 6-8% yield with balanced Bitcoin exposure across different risk profiles. Regular rebalancing ensures maintaining target allocations as market conditions change.

Key Considerations:

- Monitor correlation between different securities

- Rebalance quarterly to maintain target allocations

- Consider tax-loss harvesting opportunities

Risk Analysis and Mitigation Strategies

Primary Risk Factors

Bitcoin Price Risk: All Strategy securities carry significant exposure to Bitcoin price movements. A sustained decline in Bitcoin could pressure all positions, with MSTR experiencing the most severe impact and preferred securities facing dividend payment challenges.

Liquidity Risk: Preferred securities trade with lower volumes than MSTR, potentially creating challenges during market stress. STRD, as the newest issuance, faces the highest liquidity risk.

Credit Risk: Strategy’s ability to service preferred dividends depends on its operational cash flow and ability to access capital markets. Extended Bitcoin bear markets could pressure these capabilities.

Regulatory Risk: Changes in cryptocurrency regulations could impact Strategy’s business model and the tax treatment of its securities.

Concentration Risk: All securities represent concentrated exposure to a single company’s Bitcoin strategy, lacking diversification benefits.

Risk Mitigation Strategies

Position Sizing: Limit total Strategy exposure to appropriate percentage of overall portfolio (typically 5-15% depending on risk tolerance).

Diversification: Maintain positions across multiple Strategy securities to reduce single-instrument risk.

Rebalancing: Implement systematic rebalancing to maintain target allocations and lock in gains during volatile periods.

Stop-Loss Orders: Consider implementing stop-loss orders for MSTR positions to limit downside risk.

Hedging: Advanced investors may use options strategies to hedge downside risk or generate additional income.

Tax Implications and Considerations

Dividend Treatment

Preferred stock dividends (STRK, STRF, STRD) generally qualify for favorable tax treatment as qualified dividends, taxed at long-term capital gains rates (0-20%) for most investors. This provides a significant tax advantage compared to ordinary income tax rates.

MSTY distributions are typically treated as ordinary income, with the ETF providing annual tax reporting of the income composition. The high distribution rate means significant annual tax implications for taxable accounts.

Conversion and Capital Gains

STRK’s conversion feature may trigger capital gains events when exercised. The tax treatment depends on the holding period and the difference between the conversion value and original cost basis.

Tax-Advantaged Accounts

Consider holding these securities in tax-advantaged accounts (IRAs, 401(k)s) to defer or eliminate tax on dividends and capital gains. This is particularly important for MSTY given its high distribution rate.

Strategic Outlook

Strategy’s multi-tiered investment ecosystem represents a unique opportunity for investors to gain exposure to Bitcoin’s potential while managing risk through different security structures. The company’s pioneering approach to corporate Bitcoin adoption has created a template that other companies are beginning to follow, suggesting the sustainability of the overall strategy.

The investment universe offers compelling opportunities across risk profiles:

- Conservative investors can access Bitcoin exposure through high-yielding preferred securities with downside protection

- Growth investors can leverage MSTR’s volatility and STRK’s conversion features for maximum upside participation

- Income investors can generate attractive yields through various preferred securities and covered call strategies

However, investors must carefully consider the risks inherent in concentrated cryptocurrency exposure and the relatively untested nature of some of these financial instruments. The success of Strategy’s model depends on continued Bitcoin appreciation, sustained access to capital markets, and the maintenance of investor confidence in the company’s execution.

As Bitcoin enters what many analysts believe could be a new phase of mainstream adoption, Strategy’s position as the largest corporate holder provides unique advantages but also concentrated risks. The company’s innovative financial engineering has created investment options that didn’t exist in traditional markets, but these come with complexity and risks that require careful evaluation.

For investors bullish on Bitcoin’s long-term prospects, Strategy’s ecosystem provides multiple avenues for participation with different risk-reward profiles. The key to success lies in understanding each security’s characteristics, maintaining appropriate position sizes, and staying informed about developments in both Bitcoin and the broader cryptocurrency regulatory environment.

The coming years will test whether Strategy’s “Bitcoin treasury” model can navigate full market cycles while continuing to generate value for investors across its diverse security offerings. Early results suggest the strategy has merit, but investors must remain vigilant about the inherent risks and volatility associated with this groundbreaking approach to corporate finance and cryptocurrency investment.

The information presented in this article is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risks, including the potential for total loss. Always conduct your own research and consult with qualified financial professionals before making investment decisions.