Understanding the 8% Hidden Tax on Your Wealth

Based on Raoul Pal’s groundbreaking analysis, we’re living through an unprecedented era of currency debasement that’s silently eroding wealth at an alarming rate. Since 2008, global central banks have synchronized their debt refinancing cycles, creating a predictable four-year pattern that coincides with the US presidential cycle and Bitcoin halving cycle. This systematic approach to managing overwhelming debt burdens has resulted in what Pal calls “The 8% debasement trap“.

Visual representation of currency debasement impact on different asset classes

The mechanics are straightforward but devastating for unprepared investors. Governments are debasing currency at approximately 8% annually to service their debts, while official inflation appears around 3.5%. This means investors need to achieve roughly 12% annual returns just to maintain their purchasing power. As Pal explains, “Your hurdle rate to break even is around 12%, which is the 10-year average returns of the S&P 500… just to keep your purchasing power”.

The Shocking Truth About Asset Class Performance

When viewed through the lens of currency debasement, the investment landscape looks dramatically different than conventional wisdom suggests. The S&P 500, long considered the gold standard of investing, barely breaks even against debasement. After adjusting for the 8% annual currency debasement rate plus 3.5% inflation, most traditional asset classes fail to preserve purchasing power.

Gold, often touted as the ultimate inflation hedge, performs its intended function too well—it simply maintains purchasing power rather than growing wealth. As Pal notes, “Gold complete almost flatline really versus debasement as it should be, right? That’s gold’s job to be the stable currency”. Real estate, bonds, and commodities all underperform when adjusted for true debasement.

The data reveals a stark reality: from 1836 to 2011, gold’s average annual real rate of return was only 1.1%, while the S&P 500’s inflation-adjusted return has averaged 6.47% since 1957. However, when factoring in the additional 8% debasement rate, these returns become inadequate for wealth preservation.

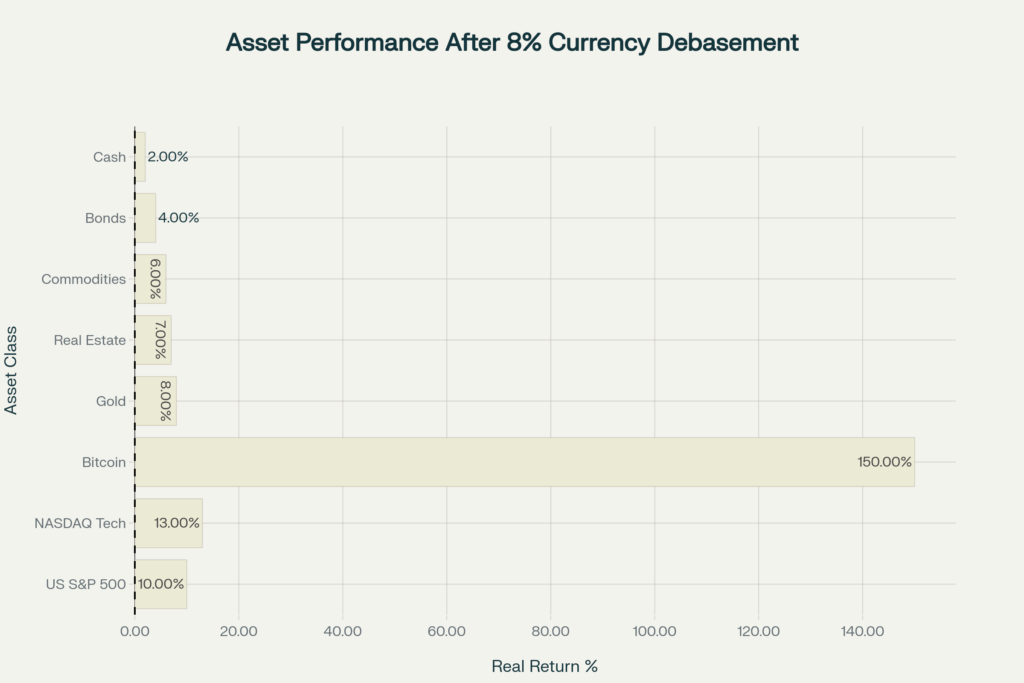

Asset Performance After Currency Debasement – Only Tech Stocks and Bitcoin Beat the 11% Hurdle Rate

The Only Two Asset Classes That Win

Only two asset classes consistently outperform the debasement rate: technology stocks and Bitcoin. The NASDAQ has delivered approximately 13% annual returns in excess of debasement, while Bitcoin has achieved an astronomical 150% annual return since 2011. This isn’t coincidental—these assets possess unique characteristics that allow them to thrive in a debased currency environment.

Technology stocks benefit from exponential adoption curves, network effects, and the ability to scale without proportional increases in costs. Companies like Google, which produces average annual returns of almost 30% with no debt, demonstrate how technology firms can maintain pricing power regardless of interest rate environments. The NASDAQ’s inflation-adjusted annual growth rate has been 11.21%, significantly outpacing traditional assets.

Bitcoin represents the ultimate debasement hedge, with 99.996% deflation against the US dollar over the past decade. Its programmed scarcity and decentralized nature make it immune to government monetary policy. From 2020 to 2025, Bitcoin rose roughly 960% while the US Dollar Index rose just 12%. When adjusted for inflation, Bitcoin’s real purchasing power demonstrates remarkable resilience compared to fiat currencies.

Investment Strategies to Beat Debasement

Given this analysis, traditional portfolio diversification becomes counterproductive. As Pal explains, “diversification just destroys returns now because you’ve got one clear macro factor”. Instead, investors need concentrated exposure to assets that outperform debasement.

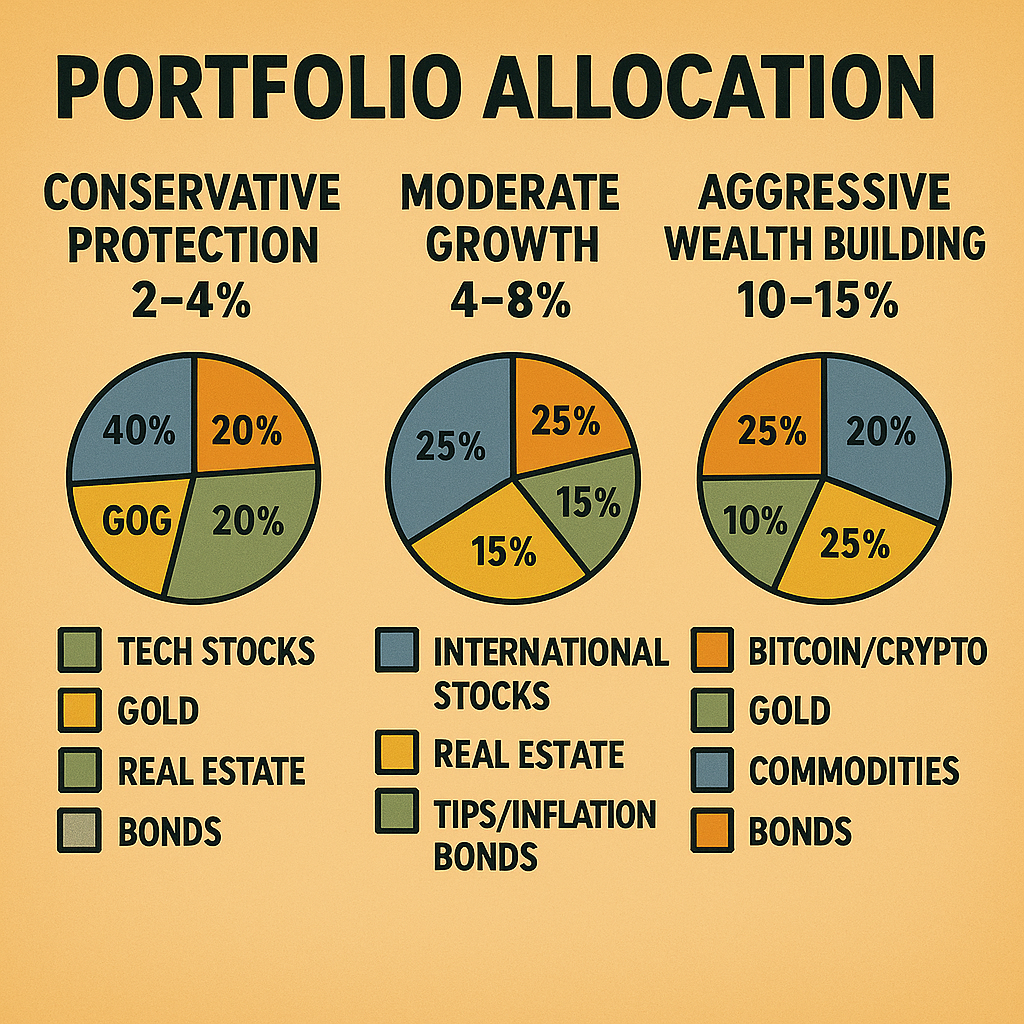

Conservative Protection Strategy (Expected Real Return: 2-4%)

For wealth preservation with moderate debasement protection:

- Tech Stocks: 15% – Focus on established technology companies with strong balance sheets

- Bitcoin/Crypto: 10% – Conservative exposure to digital assets

- Gold: 20% – Traditional store of value for stability

- Real Estate: 25% – Tangible assets with inflation-linked rents

- International Stocks: 15% – Geographic diversification

- Commodities: 10% – Basic materials hedge

- TIPS/Inflation Bonds: 5% – Government-backed inflation protection

Moderate Growth Strategy (Expected Real Return: 4-8%)

Balanced approach suitable for most investors:

- Tech Stocks: 25% – Increased exposure to growth technology

- Bitcoin/Crypto: 20% – Meaningful digital asset allocation

- Gold: 15% – Reduced but maintained precious metals

- Real Estate: 20% – Continued real asset exposure

- International Stocks: 10% – Selective global exposure

- Commodities: 5% – Minimal commodity allocation

- TIPS/Inflation Bonds: 5% – Basic inflation protection

Aggressive Wealth Building Strategy (Expected Real Return: 10-15%)

Maximum exposure to debasement-beating assets:

- Tech Stocks: 40% – Heavy concentration in technology leaders

- Bitcoin/Crypto: 30% – Significant digital asset commitment

- Gold: 10% – Minimal precious metals allocation

- Real Estate: 15% – Focused real estate exposure

- International Stocks: 5% – Limited global diversification

- Commodities: 0% – No commodity exposure

- TIPS/Inflation Bonds: 0% – No traditional bonds

Investment Strategy Allocations to Beat Currency Debasement – Three Portfolio Approaches

Tactical Implementation Recommendations

Immediate Actions:

- Reduce Traditional Asset Exposure: Minimize holdings in conventional bonds, cash, and broad market index funds that fail to beat debasement.

- Increase Technology Allocation: Focus on companies with strong network effects, scalable business models, and pricing power. The energy equity sector provides the best potential inflation hedge among financial assets.

- Establish Bitcoin Position: Start with a 10-30% allocation based on risk tolerance. Bitcoin’s correlation with global M2 money supply makes it an effective debasement hedge.

- Geographic Diversification: Invest in international assets, particularly in countries with stronger monetary policies. This includes foreign stocks paying dividends in stable currencies and real estate in fiscally conservative nations.

- Commodity Exposure: While not the strongest performer, commodities provide some inflation protection, particularly energy resources and agricultural products.

Long-term Strategy:

The debasement trend will likely continue for the foreseeable future as governments face overwhelming debt burdens and demographic challenges. Pal estimates about six years before AI and robotics fundamentally reshape the economy, suggesting this investment framework remains relevant for the medium term.

Investors should focus on assets with scarcity characteristics, pricing power, and the ability to benefit from technological disruption. The traditional 60/40 portfolio allocation is obsolete in a world where currency debasement dominates asset pricing.

As Pal concludes, “Once you see it like that… it makes it easy which is just own the one asset that outperforms”. While diversification across multiple debasement-beating assets remains prudent, the concentration should be on technology and digital assets rather than traditional diversification across asset classes that fail to preserve purchasing power.

The choice is clear: adapt to the new monetary reality or watch your wealth quietly erode at 8% annually while governments continue their debt-fueled debasement strategy. The data strongly suggests that only investors positioned in technology stocks and Bitcoin will truly grow their wealth in this environment.

The information presented in this article is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risks, including the potential for total loss. Always conduct your own research and consult with qualified financial professionals before making investment decisions.