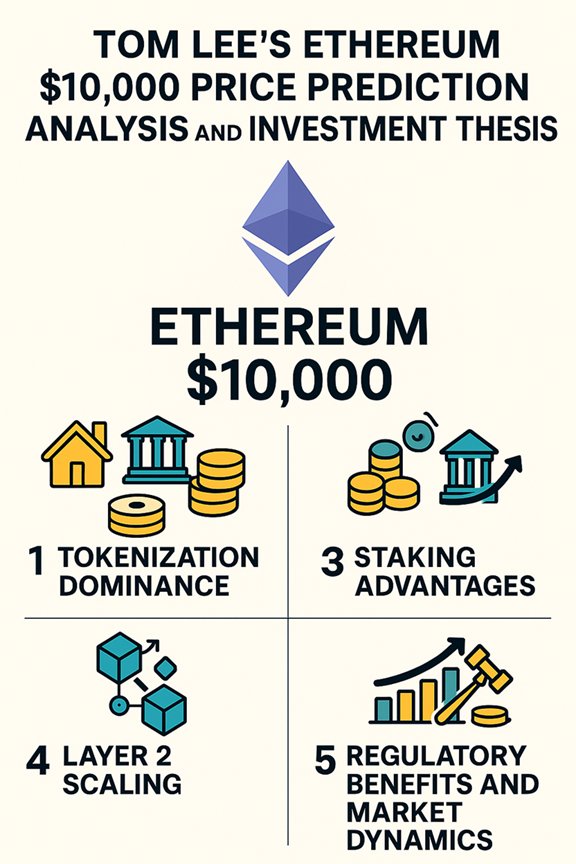

As Bitcoin celebrates its impressive run to over $100,000, a compelling case emerges for why savvy investors should redirect their attention to Ethereum. Tom Lee, the renowned fund manager and founder of Fundstrat Global Advisors, has made headlines with his bold prediction that Ethereum could reach $10,000—a staggering 299% increase from current levels. His thesis, grounded in real-world asset tokenization and institutional adoption trends, reveals why Ethereum represents the superior investment opportunity for 2025 and beyond.

The Tokenization Revolution: Ethereum’s Golden Opportunity

The global shift toward tokenizing real-world assets represents perhaps the most significant opportunity in blockchain history. Ethereum dominates this space with an iron grip, controlling 86% of all real-world assets on blockchain networks, totaling $5.8 billion in tokenized assets. This isn’t just about digital currencies—it encompasses everything from real estate and commodities to private company shares and intellectual property.

Tom Lee’s analysis reveals the profound implications of this trend. Circle, the issuer of USDC stablecoin, trades at approximately 100 times EBITDA despite operating primarily on Ethereum’s infrastructure. As Lee astutely observes, “if you look at the tech stack, typically, the more you get into that layer-1 level, the higher the multiple should be for the business, because it actually benefits from the multiple applications sitting on top of it”. This valuation disconnect suggests Ethereum is dramatically undervalued relative to the companies building on its platform.

Major corporations are already embracing Ethereum for tokenization. Robinhood announced plans to tokenize private companies, while Coinbase’s Base network operates as an Ethereum Layer 2 solution. BlackRock, Deutsche Bank, and other financial giants have chosen Ethereum for their tokenization projects, recognizing its stability and regulatory compliance advantages.

The Staking Advantage: Passive Income Generation

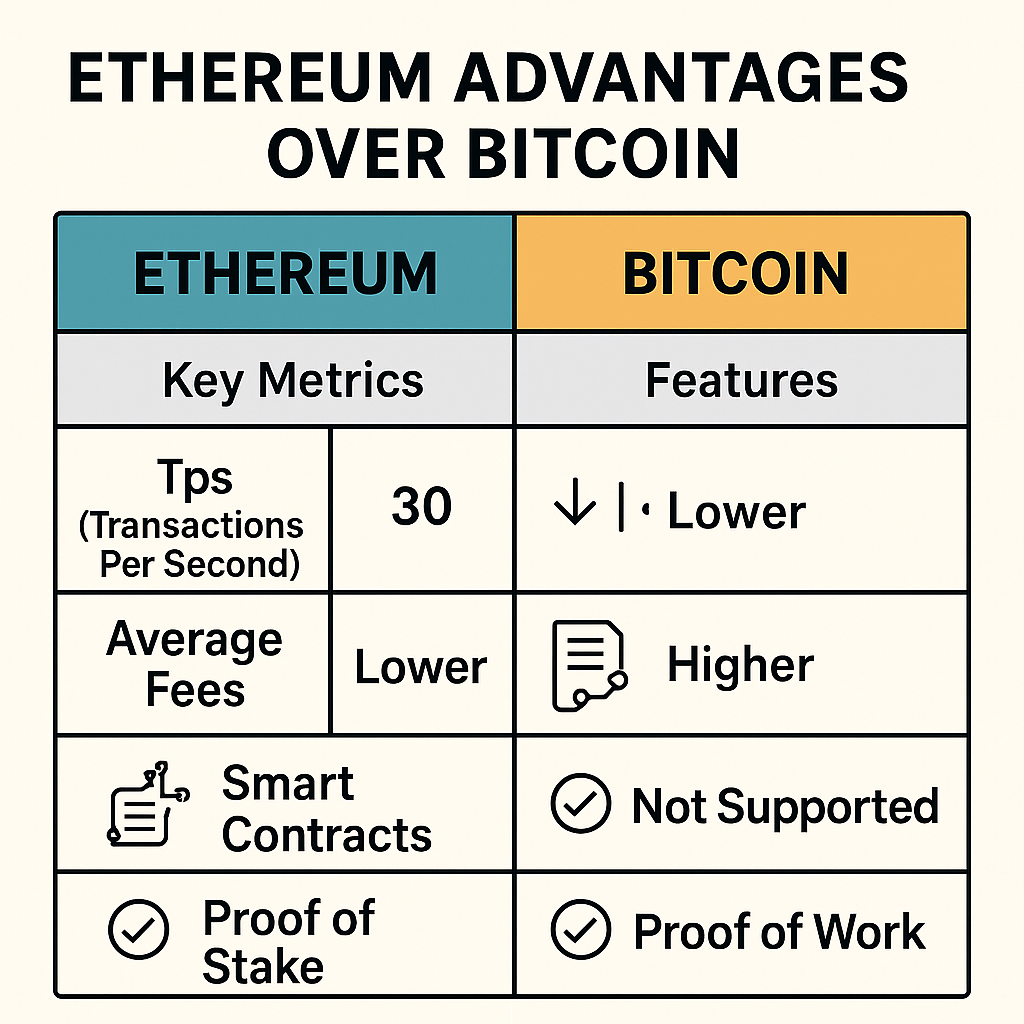

Unlike Bitcoin’s energy-intensive mining model, Ethereum’s proof-of-stake mechanism offers investors a compelling value proposition through staking rewards. Current Ethereum staking yields range between 2-5% annually, providing passive income that compounds over time. This creates a structural advantage for Ethereum treasury companies, as Tom Lee explains: “there is a yield you can earn on Ethereum by staking. So you actually can grow your Ethereum per share from that income activity”.

The environmental implications are equally significant. Ethereum’s transition to proof-of-stake reduced its energy consumption by 99.95%, making it approximately 7,000 times more energy-efficient than Bitcoin. This sustainability advantage positions Ethereum favorably with ESG-conscious institutional investors who are increasingly prioritizing environmental responsibility.

Superior Volatility for Treasury Companies

Tom Lee’s analysis reveals another crucial advantage: Ethereum’s volatility is actually twice that of Bitcoin. While this might sound counterintuitive, higher volatility translates to more efficient capital markets access for treasury companies. As Lee explains, “the higher the volatility you have, the more you can sell volatility and then lower your cost of borrowing”. This enables Ethereum treasury companies to acquire more coins per share at lower funding costs compared to Bitcoin-focused strategies.

Institutional Adoption Accelerating

The institutional adoption of Ethereum has surged 54% in the past 90 days, with major financial institutions recognizing its utility beyond simple value storage. Ethereum’s market capitalization now exceeds $300 billion with 9.10% market dominance, while its role as the foundation for decentralized finance, NFTs, and smart contracts continues expanding.

Circle’s remarkable valuation trajectory illustrates this trend. The company has achieved a market valuation of $66.9 billion, actually exceeding the $61.3 billion circulating supply of its own USDC token. This valuation premium reflects the underlying value of Ethereum’s infrastructure in supporting the broader stablecoin ecosystem.

Layer 2 Scaling: The Network Effect Multiplier

Ethereum’s Layer 2 ecosystem processes 11-12 times more transactions than the main Ethereum chain, creating a powerful network effect that Bitcoin lacks. Popular Layer 2 solutions like Optimism, Arbitrum, and zkSync Era have dramatically reduced transaction costs while maintaining Ethereum’s security guarantees. This scaling infrastructure enables complex financial applications that would be impossible on Bitcoin’s more limited network.

The Regulatory Advantage

Ethereum benefits from operating primarily under U.S. jurisdiction and regulation, providing institutional investors with greater legal certainty compared to other blockchain platforms. Tom Lee emphasizes that “Ethereum is mostly U.S.-based or operates under U.S. regulation, making it a safer and more reliable option for handling tokenized financial products”. This regulatory clarity becomes increasingly valuable as traditional finance embraces blockchain technology.

Market Dynamics Favoring Ethereum

While Bitcoin has captured headlines with its treasury company trend, Ethereum presents a more compelling risk-adjusted opportunity. The ETH/BTC ratio is positioned for a potential reversal, with analysts projecting it could climb to at least 0.06—nearly double current levels. This would trigger a broader altcoin season, reducing Bitcoin’s market dominance from 57% to approximately 45%.

Ethereum ETF approvals and staking-enabled funds represent significant catalysts for 2025. Unlike Bitcoin ETFs that simply track price movements, Ethereum ETFs with staking capabilities would generate additional returns for investors while removing technical barriers to participation.

Looking Beyond Digital Gold

Bitcoin’s narrative as “digital gold” has undoubtedly driven impressive returns, but this positioning also limits its growth potential. Ethereum’s utility-driven value proposition offers multiple expansion vectors: smart contracts, DeFi protocols, NFT marketplaces, and now real-world asset tokenization. Each use case creates additional demand pressure that Bitcoin’s store-of-value model cannot match.

The total value locked in DeFi protocols is projected to exceed $300 billion, far surpassing the previous 2021 peak of $180 billion. This growth directly benefits Ethereum as the primary infrastructure layer supporting these applications.

The Investment Thesis

Tom Lee’s $10,000 Ethereum prediction isn’t speculative—it’s based on fundamental value analysis. As he notes, “if the world suddenly realized we’re going to tokenize more things, and these tokenized assets like tokenized dollars trade at 100 times EBITDA, what should the blockchain be valued at? ETH should maybe be worth a lot more money”.

The convergence of institutional adoption, regulatory clarity, technological scaling, and real-world asset tokenization creates a perfect storm for Ethereum’s appreciation. While Bitcoin may continue its role as digital gold, Ethereum is positioned to become the backbone of the tokenized economy—a far larger and more valuable market opportunity.

For investors seeking exposure to the future of finance rather than just an alternative store of value, Ethereum represents the superior choice. The question isn’t whether to invest in crypto, but whether to choose the network that powers the entire ecosystem or settle for digital gold. In 2025, that choice seems increasingly clear.

The information presented in this article is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risks, including the potential for total loss. Always conduct your own research and consult with qualified financial professionals before making investment decisions.